With the growth of the crypto market, more and more people are looking to invest in Bitcoin. However, something that many newbies do not know is that, for this, it is necessary to have a Bitcoin wallet, used to receive and send the coins, in addition to storing them. Therefore, this post will explore the function of cryptocurrency wallets, in addition to teaching you how to create one so you can start investing.

Bitcoin is a digital currency based on blockchain technology. They are generated by the mining process in which several devices use their computational capacity to solve operations validation equations, creating new blocks in the network and, with that, new coins. To have access to these coins, it is necessary to have the cryptographic key of their address on the network. That’s where the Bitcoin wallet comes in.

Although its nomenclature is based on the general process of having access to money and being able to carry out operations, Bitcoin wallets work in a very different way from traditional wallets. They do not directly store the coins, but the cryptographic information that leads to their address on the blockchain and can authorize transactions with these coins on the network. This information is accessed from the so-called private key.

Bitcoin Wallet Keys

Bitcoin wallets have two main pieces of information: the private key and the public key. The private key, as already mentioned, keeps the address of the Bitcoins in the wallet, and allows transactions to be authorized. It works like a password, being composed of 64 characters generated from a 12-word phrase. As the name implies, this key must be private, kept very securely and never shared with anyone, as it basically works as the key to your Bitcoin vault.

The public wallet works as an address to receive transfers. Thus, it identifies your account on the network and must be shared with whoever sends Bitcoins to your wallet. Think of it like an email address. However, as it is possible to see the history of transactions from the public key, there are ways to generate new public keys for each transaction, allowing users to obtain greater privacy.

It is with these two keys, then, that it becomes possible to carry out all operations with Bitcoins. Each cryptocurrency will use its own keys, due to having its own addresses in their networks, and therefore technically they would need their own wallets. However, there are several wallets capable of storing different keys, allowing transactions with all types of crypto, and even NFTs.

What are the types of Bitcoin wallets?

There are several different ways to store the keys to access your Bitcoins. Based on this, the types of portfolios are characterized, divided into five categories. Because of this, it is common for people to wonder what is the best Bitcoin wallet or to store cryptocurrencies. However, there is no definitive answer, since each type has its advantages and disadvantages, and it is up to the user to choose what he considers best. To arrive at this choice, follows a description of each of the existing types, along with their qualities and defects.

Hardware Wallets: An offline storage device, such as a hard drive or USB stick, that is specifically designed to function as a cryptocurrency wallet. It is considered the most secure type of wallet, as the keys never leave the device, it only needs to be plugged in to confirm transactions. A hardware wallet cannot connect to the internet, which prevents any possibility of hacker attacks, and the operating system is extremely specific, making it immune to viruses. It also has extra layers of security, such as pin codes, which prevent someone stealing from gaining access to your funds. In case it is stolen, lost, or stops working, it is possible to reuse the private key generation phrase in another wallet to generate a new key and regain access to the funds.

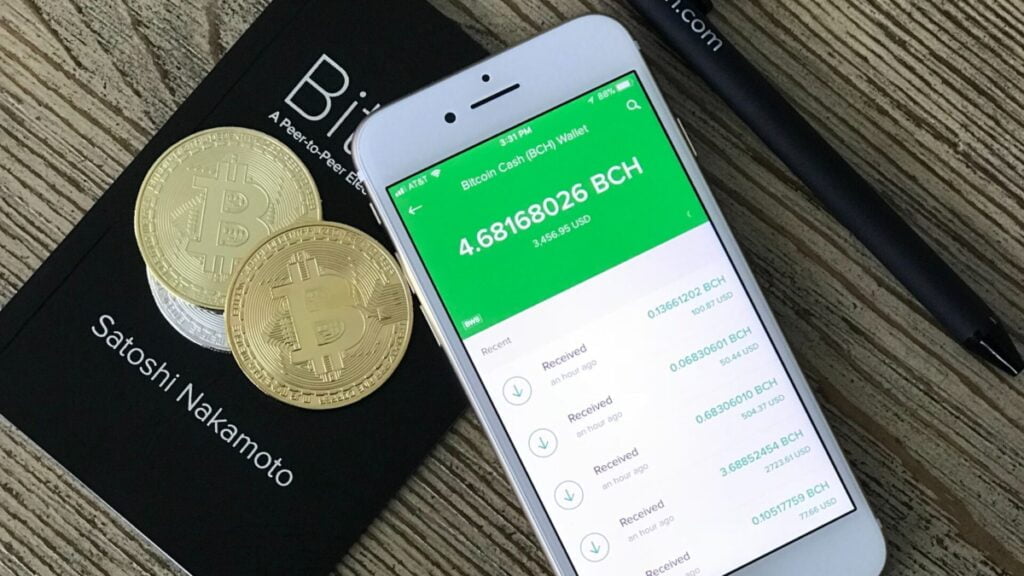

Mobile wallets: Wallet applications that can be installed on smartphones. They are great options for people who carry out a lot of crypto transactions throughout the day, as they allow easy access from anywhere on the phone, and it is even possible to authorize transactions by approximation with NFC technology. However, they end up being much more susceptible to theft, scams, viruses or hacker attacks because of this. Because of this, it’s critically important to enable two-factor authentication (2FA) if using mobile wallets, adding a second layer of security. Even so, they are still less secure than hardware wallets, and therefore it is advisable to have only the small amount needed for transactions in this type, keeping the rest more securely.

Desktop wallets: These are programs installed on personal computers and laptops, compatible with Windows, Mac and Linux. Thus, the wallet keys are saved on the computer, and can be used without the need for an internet connection. These programs are more advanced than mobile apps, allowing for more functionality and security. Still, computers are susceptible to viruses and hacker attacks, making desktop wallets less secure than hardware ones. Even so, they are great choices for enthusiasts and programmers, as they allow for unique and advanced features, such as the possibility of increasing the speed of transactions by increasing fees.

Paper wallets: These are physical documents containing keys, usually in the form of QR codes to facilitate transactions. Their advantage is that they are completely immune to hackers and viruses, but the disadvantages are also great, such as how easy it is to lose them, and worst of all, they are stolen, in which case whoever stole them will have direct access to the funds.

Exchange wallets: Finally, there are wallets made available by exchanges, companies that offer crypto transaction services. In this case, the keys will be stored on the company’s servers, and accessed from your login. These wallets make access very easy, automating the sending and receiving of Bitcoins, in addition to not having to worry about where to keep your keys. However, this comes with higher transaction fees, plus the fact that the keys are held by third parties, who can freeze your funds, ban your account, or lose everything in major hacking attacks. Because of this, some well-known exchanges like Binance offer some degree of protection against such losses, with insurance and reserve funds. In addition, there is also the use of 2-factor authentication to prevent accounts from being easily hacked.

How to Create a Bitcoin Wallet

After learning about all types of wallets, the user may have decided on one of them, without knowing exactly where to start to create it. First of all, it is very important to remember that dealing with Bitcoins is dealing with money, and a lot of research on the subject is essential before any investment. From there, it will depend on the type of portfolio chosen.

In the case of choosing a hardware wallet, it will be necessary to purchase the device. There are a number of different hardware wallets, with the most renowned currently being the Ledger and Trezor brands. Each model will have its particularities, such as more layers of protection, screens, touch screen, which also results in different prices. All of this is up to user preferences, but what really matters is making sure you’re buying a reputable device. That’s because there are many unknown and cheap devices that are actually scam attempts, containing code to steal Bitcoins from those who use them. Also, it is important to only buy new devices as a used one may also contain malicious code to steal funds.

As for mobile and desktop wallets, you must find the desired program, download it and install it on your preferred device. The main desktop wallets currently are Sparrow, Sparrow, Metamask and Wasabi, while the main mobile ones are Muun Wallet, Trust Wallet and Blue Wallet. There are also wallets with versions for both desktop and mobile, with the main ones being Electrum, Exodus and Atomic. Again, the same knowledge of hardware wallets applies, in which each wallet will have its own functions that must be considered by the user, in addition to the fact that it is important to only use reputable wallets, as there are also many unknown applications and programs with the sole purpose of stealing funds.

As for paper wallets, the user is completely responsible for how to assemble his wallet. The best way is to use a clean offline device to generate the keys, then turn them into QR codes with offline programs and print these codes on an offline printer as well. It is not necessary to do it this way, but it is the safest way, as it avoids any possibility of data being stolen. Finally, the printed wallet must be protected so that it is not easily damaged, either by laminating it or using other materials.

Finally, exchange wallets are created after registering an account. Binance is the main one, and can be accessed both through the browser and the mobile app. After creating an account, just select the type of wallet to be created and start using it. As already mentioned, always use only trusted exchanges, and make sure you have additional safeguards like two-step verification turned on.

Read more about Bitcoin:

- Find out some of the most promising cryptocurrencies in 2023

- What’s the best way to sell Bitcoins and convert them into dollars?

- Virtual workers: What is Bitcoin mining?

Caution is everything, protect your keys!

Something that should have been very clear during this text is the focus on security. After all, Bitcoin is money, so your wallet needs to be very protected, this includes good habits like never using your wallet on potentially compromised devices, avoiding writing your private key in plain text documents, or even worse, sending it in online messages. As far as possible, it’s best to avoid having your wallet on any device that connects to the internet, but if that’s not possible, make sure your device is secure and free of viruses and malicious software.

Apart from attempts at digital attacks, it is always good to remember about precautions against physical theft as well. After all, if someone steals your computer with your wallet, they might also have access to your funds. That is why it is important to ensure that your device has several defenses against third-party access, such as a password to log in and to access the wallet.

A very important thing besides guaranteeing the security of your wallet against third parties, is protecting against yourself. There have been many cases over these two decades of Bitcoin’s existence that people have lost their devices with their keys and forgotten their generative phrases, only to see Bitcoin appreciate exponentially afterwards.

One of the greatest examples of this was James Howells, a Welshman who accidentally threw his hard drive containing 8,000 Bitcoins in the trash in 2013. At that time, that value was already the equivalent of about US$ 240,000, but today that value is more than US$ 230 million.

There are several other similar cases, serving to remind us that there is little care. When dealing with a Bitcoin wallet, you are dealing with cash. So protect your keys, commit your generative phrase to memory, and avoid becoming yet another cautionary tale.

Translation by Laura Bonci