Perhaps you have already come across the word “Satoshi” when reading articles and watching videos about the world of cryptocurrencies, after all, this name is quite common in the crypto universe. However, before explaining the meaning of Satoshi it is important for us to understand what Bitcoin is and how this cryptocurrency has revolutionized the financial market in recent years.

Bitcoin is the first virtual currency created in the world and its release took place in 2008. However, the true identity of its creator is the subject of much speculation. There are two main theories: In the first theory, Bitcoin is believed to have been created by a single guy named Satoshi Nakamoto. In the second theory, others suggest that this is a group of people using the name as a pseudonym. Regardless, the emergence of Bitcoin has been a milestone in the history of cryptocurrencies and the global financial system.

One of the reasons to consider the existence of a pseudonym is the meaning of the name in Chinese. “Satoshi” means “clear thinking, quick intelligence”, “Naka” means “interior” and “Moto” means “base, origin”. Regardless of being a person or a group, this is a mystery that remains to this day. I particularly like the idea that the boy was born with the right name for success, how about you?

Understand the differences between Bitcoin and Satoshi

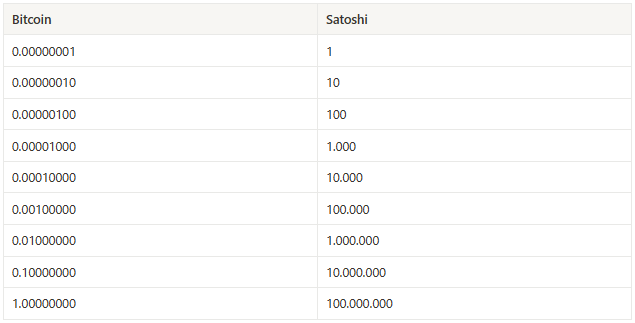

In order to illustrate the differences between Bitcoin and Satoshi, we can resort to a simple comparison common in our daily lives: if Satoshi were a currency of the physical world, it would be the equivalent of cent coins, while BTC (short for Bitcoin) would be as a higher denomination note. In other words, Satoshi is nothing more than a fraction of Bitcoin, just as cents are fractions of dollar. And just as the dollar can be divided into cents, Bitcoin can be subdivided into Satoshi.

One of the characteristics that make Bitcoin such a unique cryptocurrency is the fact that it is decentralized, that is, not subject to the control of any central bank or government, being managed by its own users through a peer-to-peer network. This decentralization has been one of the main reasons for its increasing popularity on the internet, as many people are looking for alternatives that allow them to have greater control over their finances and that are not subject to the restrictions imposed by traditional financial institutions.

The smallest unit of measurement for Bitcoin is the SATS, the acronym used to identify a Satoshi. The value of a SATS in reais varies directly according to the value of Bitcoin, which is a highly volatile currency, subject to significant variations in short periods of time. It is important to highlight that this volatility is one of the characteristics that make Bitcoin a risky investment option, which requires good knowledge of the market and an adequate investor profile.

You may be wondering what the current value of Satoshi in dollar is, for that it is necessary to check the Bitcoin quotation in reais at the time of your search and use the formula “Bitcoin quotation in dollar / 100,000,000”, the result will be the value of Satoshi in dollars.

Remember I mentioned that Bitcoin can be subdivided into SATS? No wonder, SATS is not the only unit of measurement to fractionate a Bitcoin. In addition to SATS, which is the most popular unit, it is possible to use Millibitcoin, equivalent to 0.001 BTC, and Microbitcoin, which corresponds to 0.000001 BTC. The difference between these units is simply the amount of fractions that can be obtained from a Bitcoin unit. However, it is Satoshi that allows Bitcoin to be transacted in amounts low enough to be used for everyday purchases, such as a coffee or a trip to the restaurant. This characteristic is positive, as it makes the currency accessible to investors with different financial levels and helps to popularize Bitcoin through transactions that involve everyday values.

Read more about Bitcoin:

Where to buy Satoshi?

To acquire SATS, it is possible to resort to several cryptocurrency brokers that are available in the market, called exchanges. These exchanges work similarly to stock exchanges present in the real world, where users can buy and sell cryptocurrencies at will. Among the most well-known brokers, we can mention Binance, which is famous for its cost-effectiveness, Mercado Bitcoin, which is the largest LATAM platform and Foxbit, which offers great deposit facilities. In addition to these, other options are also available such as KuCoin, Bitso, BitcoinTrade, Coinext and many others.

Over time, SATS mining has become an increasingly difficult and less profitable activity for ordinary users, as competition among miners has increased exponentially. Previously, cryptocurrency mining was an advantageous option for those with available computing power, as they could earn coins as a reward for validating transactions on the network.

However, mining is currently dominated by large farms using specialized hardware for large-scale mining, which significantly reduces the profits of individual users who do not have access to this technology.

Still, for those with an interest in trying mining, there are some options such as pool mining, which allows multiple users to combine their resources to increase mining power and thus have greater chances of reward.

Caution in the cryptocurrency market

The world of cryptocurrencies undoubtedly offers the possibility of making significant profits, but one has to be aware that it also presents significant risks. Therefore, it is critical that investors take precautions to protect themselves against fraud and scams. Some of the key measures include:

1. Choosing a reliable cryptocurrency exchange: It is possible to check the reputation of exchanges in different ways, search for reviews, enter forums, talk to other investors, be suspicious if the opportunity seems too tempting and above all, look for the exchange’s history to find out if there have been any leaks, loss of funds or other problems.

2. Authenticity of the sites: Before entering your personal and financial information, look for ways to inform yourself about the authenticity of the site, make sure you are in a safe and scam-free environment.

3. Wallet security check: There are several options for digital wallets in the crypto market, after extensive research, the question you should ask yourself is: “Which best suits my needs and offers the highest level of security and protection?”.

4. An important question to ask yourself before investing is: “Would I be able to sleep soundly at night if I lost this amount on investments?” We must not neglect the importance of keeping our mental health up to date, even when it comes to investments. To enter the world of investments, it is recommended that you have an emergency reserve and start with small amounts to familiarize yourself and know your limits. Market fluctuation is huge, especially when it comes to Bitcoin, so it is essential to understand how much risk you are willing to take.

5. Keep up to date with the market: When dealing with the cryptocurrency market, it is essential that you have a good understanding and mastery of the technologies involved. Keeping up with industry news and trends is essential so you can make more informed decisions and avoid unnecessary losses. Always remember that we are talking about your money, and it is important to have a good understanding and mastery of the subject.

Finally, when considering transactions involving Satoshi and Bitcoin, it is critical to keep in mind that these transactions cannot be reversed. This characteristic, although drastic, is a standard in blockchain networks that has been shown to be effective in guaranteeing the security of transactions against possible fraud.

Translation by Laura Bonci